Turning your dreams into reality.

Going into business yourself properly can be a really scary prospect! As much as we moan about our jobs and think we could do better, very few of us actually stump up the courage to leave the comfort blanket of full time employment behind and go it alone. And that’s fair enough, with family and bills to consider it’s not always as easy as just giving it a go and taking those risks.

Your company which you work for, would of been started by maybe one or two people. Maybe a family. Maybe a funded startup. It became successful, it employed people (including you) and every day it has to manage its finances, the wage bill, keeping the lights on, finding new customers, it’s not easy. Meanwhile as a PAYE employee you go home every night safe in the knowledge you’ll receive your pay check at the end of the month. (less the National Insurance & Income Tax).

So why bother?

For years I’ve straddled the fence mere ‘playing’ at running a business, whilst I did that and a full time job too. Where as in later years I’ve run a registered dormant company on the side as I’ve gotten to grips with home accounting, the HMRC minefield & suffered at the hands of them for missed VAT filings & such like. It’s not easy running a company legitimately here in the UK. Especially if you want to do things properly right from the off.

For years when I worked for small businesses I’d baulk at their sloppy accounts, bailiffs at the door, the constant closing down of one company only to set up again tomorrow game, and whilst none of that is acceptable it’s more understandable when you start to realise how difficult it can be to run your business.

I was wrong to be judgemental though.

When I was younger, I was enamoured by one of my bosses. He was immaculately dressed, had charisma and charm by the bucket load and drove a Range Rover Vogue SE. I held him in such high regard. I fell in love with that car and we’ll come onto that in a moment, but watching him was my initial impetus to want to run my own business. (Ironically I watched that same guy get escorted out of his offices by the police to go on trial for multi million tax fraud, but that’s another story for another time!).

The time is now.

Despite that, and after much thought, the end of April this year was my ‘Eureka!‘ moment. As my business has constantly ebbed & flowed over the years providing a much appreciated but small secondary income it had started to pay for itself. If you’ve ever experienced any kind of what others would call ‘success’ from hard work, you’ll know it rarely happens overnight.

Turning your dreams into reality.

In fact, you don’t notice it is happening at all as you’re too busy working. But slowly MD Technology Services started to pay for bills. It got us out the shit when our oven went kaput and we needed a new one. It started to pay for the odd direct debit here or there and slowly I learnt that this was actually becoming a proper business. Not an ‘I run a business’ business, because EVERYONE AND THEIR DOG runs their business, but a proper business which actually makes proper money.

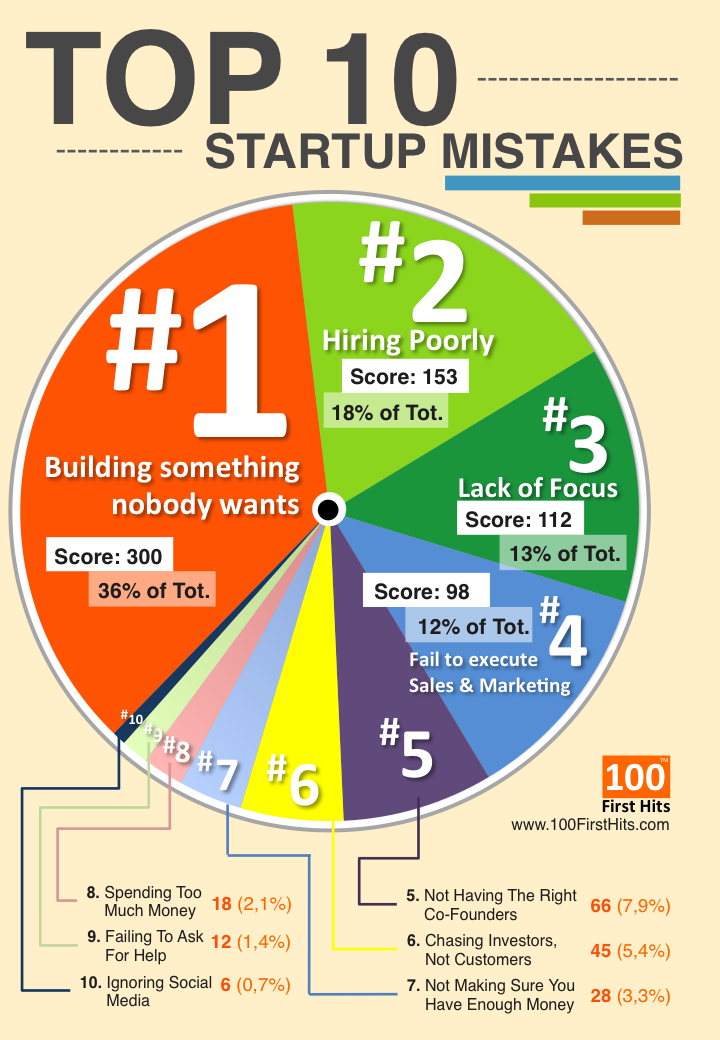

(img. courtesy of Cape Ventures)

So, it was brave of me to leave my full time paid job to focus all my energies onto my own business. Now taking on my biggest client so far, this long term contract will be my flight or fail moment. I think at my still spritely age of 37, I’m ready to take some calculated risk and with all the achievements I’ve had & all the things I’ve learnt (including the mistakes I’ve made along the way) I’m ready for this. Am I? Really? Gulp….

Why take on the pressure, the stress? Why? Because I wanted more. I was quite happy to say I wanted a big house, a car (The Range Rover), money in the bank, and more importantly to be able to comfortably provide for my family and for those I love. So many others around me blaming the economy, their jobs, the timing, a sheer myriad of excuses but no one really doing what they need to do instead opting to take easy routes. You can read more about why I think people’s businesses are fucked here but basically I wanted the Range Rover, so I’ve taken the funding, put all my chips in and this has to all work.

When it comes to running a business, as it’s been the topic of conversation I’ve recently helped a couple of others to do something similar. I pride myself on attention to detail and doing things properly, so to finish this article here’s a list of things you need to consider if you want to start up your own business yourself, maybe as a contractor, your new start-up, or something more;

Top Tips for your DIY future.

1) Register a company, use Company Formations 24/7 and do it yourself. You’ll receive your memorandum/articles of association & company formation certificate 24 hours later electronically. You’re then registered with companies house (When you set your company up, set up a LTD company, you as a sole proprietor, 1 single a class share to start with). You want to add yourself as a company secretary also.

2) Set up a business bank account (you will need to have a specific business account which matches the name of your company). I recommend RBS or Barclays.

3) Set up a Government gateway, assign Self-assessment to get your Unique Tax Payers Reference (UTR) & VAT returns services to your gateway ID and register for VAT. You’ll receive your VAT certificate in about 5-7 working days. Ensure you enrol for two step verification on the government portal. Make sure you KEEP the mobile phone you register with.

3.5) At this point, call HMRC yourself and advise them of your status change, you’re newly set up company and ensure they have your last P45 (this is a detail but really helps). The HMRC will update your account with the information you give them, and you can help them help you by periodically giving them a call and ensuring all your details are correct.

3.9) Purchase up to £5m of Professional indemnity insurance from either Direct Line or Axa (they are very good) & keep those certificates with your company details as you’ll need all this every time you apply for a contract of course or present yourself to a client.

4) Register with an accountant to provide you with book keeping, end of year accounts, VAT filing and summary accounts annual preparation along with monthly payroll services.

5) Learn about you will pay yourself. Typically you’ll pay yourself a small annual salary of the current 2016/2017 threshold which is about £8,500 I think and then the rest as monthly dividend payments. You’ll need to submit one of these each month (this being a meeting memo to say you’ve discussed and rewarded all shareholders with an XX payment), (or your accountant will) and you’ll need to keep these. You will be an employee for your own company. Use your own car, and charge back your mileage to client sites (never use a company car, it’s tax disadvantageous and complicated I think, but that’s for another post) and your accountant should ensure you’re ‘tax efficient’ – you can of course claim back all your tools and valid business expenses also.

You submit your VAT monthly or quarterly, summary accounts and confirmation statement once yearly (to basically say nothing’s changed) and you self-assess on your own tax affairs 31st Jan each year is the deadline. Your accountant will advise on this. If you claim child benefit or other government benefits & yet earn over the £50k threshold, expect to pay some of this back too!

6) Learn about IR35 and ensure you’re within it, taking on IR35 friendly contracts or IR35 compliant contracts. Pay for a solicitor to check each contract, it’ll be about £400+VAT but well worth it. If you are audited, and fall foul of IR35, you’ll be lumbered with bills and fee’s in excess of £5k! Fck me dead! I use Fraser Brown.

The following I recommend and more important than you think and looks more pro anyway.

1) Set up a website with your company name, add your company information, and set up a professional business email (if you’re ever audited by HMRC, this helps with proving you’re a ‘proper’ business and not conducting disguised employment), so you can’t use bigcock64@hotmail.com anymore I’m afraid either. Need a website? Get in touch with me via www.creativepixel.me.uk

2) I went to Apple lease, and leased a metric fck ton of computer equipment and software.

Your accountant will ensure this is all tax efficient – I never gamble on the client providing equipment as sometimes they don’t. So I pay about £200 a month for a Mac Book Pro, Office Cloud, Microsoft Project, an iPad, iPhone7 etc, there’s some really good deals if you don’t have the kit already.

3) Join contractorsUK forum, there’s lots of help and advice on there

4) Get income protection insurance, life insurance, and also HMRC investigation insurance (the latter I think comes included when you join the Fed. of Small Businesses)

5) Ensure you’re a member of the Institute of Directors for all kinds of perks & benefits.

Well done Mario 😀